Approach all bookkeeping software the same way, no matter the year, make and model of bookkeeping software you have (QuickBooks, Quicken, Accountedge, Peachtree, Microsoft Money, excel templates, etc).

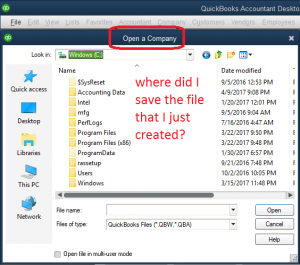

Figure out how to open the right file.

The software is a program that allows you to view and edit a file. The software may be stored in one location (e.g. Program Files) while the file it is opening may be stored in a different location (e.g. My Documents).

The software is a program that theoretically allows you to open an infinite number of files, as long as those files are readable by the program.

For example, Microsoft excel is a program that allows you to open, view and edit excel files. Microsoft excel is also capable of viewing and editing plain text files and some other types of files.

The reason I mention this is because sometimes people get the program itself confused with the file the program is opening.

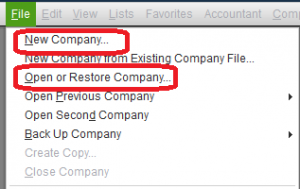

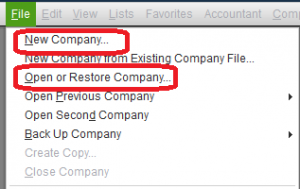

By convention, no matter what type of program you have, there is a File menu. If you click on the File menu, you will be able to either:

Create a new file

Or

Open an existing file

These choices may be presented in various ways, but the gist is the same:

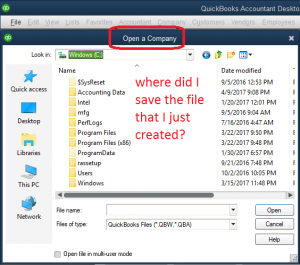

If you create a new file, be sure to note where it is saved, so that you can open that file again later:

If you have many versions of the file (the file, not the program) saved on your computer or among your team you are liable to get into trouble. This happens when a file gets sent back and forth between people, or when someone sends themselves a copy of the file to work on a different computer or saves copies of a file for other reasons. Often what ends up happening is that nobody knows which is the working file and which file is the rough draft. My solution is to one have only ONE bookkeeping file on your computer. Trash all draft files except the working file. If it turns out that you trashed the wrong file, you can hopefully retrieve it from the trash.

Ok, enough already, by now you have performed the first step: opening the right file.

Once you are in the right file, figure out how to view the check register.

The learning curve in using any bookkeeping software is two-fold:

Understanding where the software hides its menu items

Understanding accounting principles

The reason to go straight for the check register is because this will put learning curve item #2 on hold (a check register is the most instinctively understood thing about accounting, so there are no real principles to learn), leaving only learning curve item #1 to tackle.

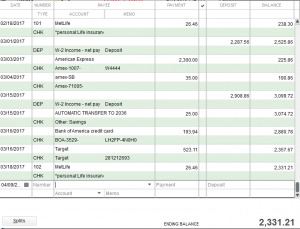

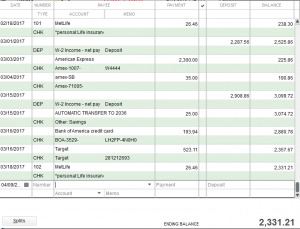

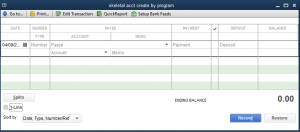

A check register looks like some variation on this:

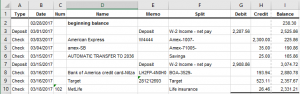

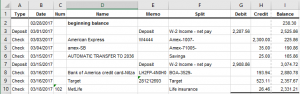

An excel check register may look like this:

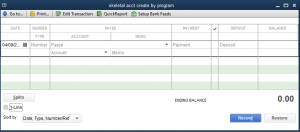

The point is, you will know it when you see it. When you are creating a new file for the first time, there will be no check register, or, if the software creates a skeletal structure, there will be an empty register:

In order to find where the program hides the check register, or how to create a bank account register, you have to google the instructions, or browse the help files. Each program is different, and each year companies that sell these software programs “improve” them by changing where the menu items are hidden. So it is up to you to poke around until you find how to create or open a check register. If you are using excel as your bookkeeping software and you don’t know how to create a check register, google the instructions. Somebody is bound to post instructions on any question you have.

Ok, once you have figured out how to get a check register in front of you, you now need to enter your first transaction into the register.

If you are taking over the bookkeeping file from a prior bookkeeper, then there already should be a bunch of transactions entered, and you just continue where the prior bookkeeper left off. This is the easiest scenario, since you can always use the prior bookkeeper’s style of entry as a model to figure out the gist of how to continue entering items.

If you are creating a company file from scratch, and creating a check register from scratch, and the bank account has newly been hatched at the bank, with a beginning balance of zero, then the first transaction will be the deposit into the bank that caused the bank account to be opened. The explanation of this amount could be any one of the following: from “income,” from “bank account xyz,” from “owner’s investment,” or from “loan.” If it is a loan, it is good to be clear whom the loan is from, so as to know whom to pay back (“loan from mafia” versus “loan from parents.”)

If you are creating a company file from scratch, and if you are entering a checking account that you have had for years, the beginning balance will be the balance on the last day of the prior year. You enter this amount as a deposit, and the explanation of this amount can be “opening balance.”

By now, you will have had all sorts of pop-up messages from the software, asking you to add names and accounts to its names list and accounts list. Humor the software by saying yes to add the names, but do not feel the need to fill out all the details about each name or account. Keep everything as minimal as possible. Do not worry about the effect of choosing the wrong name type or the wrong account type. Mistakes will be inevitable, your goal at this time is to just enter one transaction as best you can.

As an aside, if you really insist on a rule of thumb for a name type, choose “vendor.” And if you insist on a rule of thumb for an account type, choose “expense.” These are the safest choices to make when in doubt. Later, when you understand more about the program, you can at least find where you have created your objects and fish them out and correct them from there.

Ok, once you have figured out how to enter the first transaction, you now need to enter all the remaining transactions.

Watch the running balance in the register, to see if it is reasonably within range of the bank balance that shows up on the bank statement. If the balance drifts away from what the bank shows on the statement, then evaluate why it is at such variance. You may want to copy the bank statement line by line, to get a feel for the software’s ability to mimic the running balance exactly as the bank presents it to be.

As you get more sophisticated with the check register entry, you will find it much more useful to enter checks dated the day you actually write the check, rather than the date the check clears the bank. Realize that this will cause your running balance to differ temporarily with the bank’s running balance during the days that the checks are outstanding, but that the balance will eventually agree after the bank clears all the outstanding checks.

Do not do so much that you get allergic to bookkeeping. Now is a good time to take a break.